The Official State Gazette (BOE) publishes Royal Decree-Law 13/2022 that includes changes in the way self-employed workers are taxed.

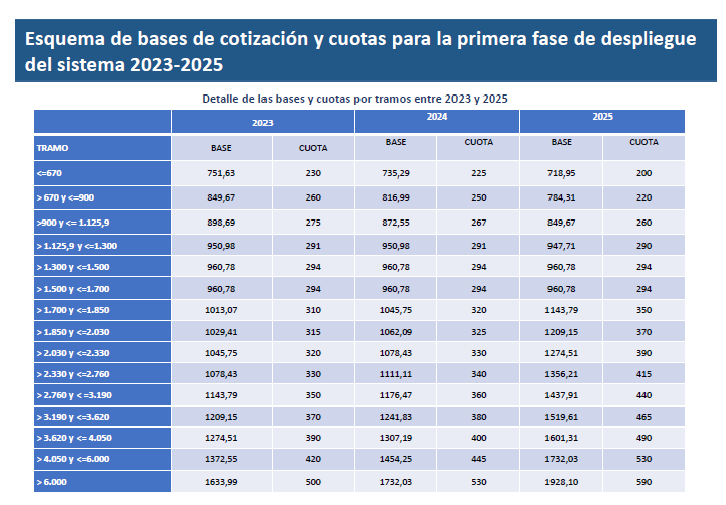

The main novelty is the new contribution tables and quotas that will come into force in 2023 and that will be modified year after year.

Self-employed workers included in this special regime will contribute based on the annual income obtained in the exercise of their economic, business or professional activities, as indicated below:

The self-employed may modify their contribution base up to 6 times per year with a periodicity of 2 months to adjust it to the returns they are obtaining.

Furthermore, in the document, the following novelties are presented:

- Economic benefit for the birth and care of a minor that will consist of a subsidy equivalent to 100 percent of the corresponding regulatory base.

- Regularization corresponding to each financial year that will be carried out in the following year and will be carried out based on the data communicated by the Tax Agency.

- Deduction for generic expenses of 7% for those individual self-employed workers, while this same deduction is reduced to 3% in the case of company self-employed workers, for the calculation of the annual income forecast.

- Reduced fee for starting activity: 80 euros per month for 12 months (extendable for another 12 for income below the SMI).

Partial cessation of activity and RED Mechanism

The new law includes the cessation of partial activity with a benefit of 50% of the regulatory base, compatible with another activity and with a duration that will range from four months to two years.

Also, it adapts the self-employed to the protection system of the RED Mechanism. This mechanism is activated by the government in the face of unfavorable general or sectoral macroeconomic situations.

The Royal Decree-Law will enter into force on January 1, 2023.